The Colonial Roots of Global Finance: Why Following Money Matters

Introduction: This project explores how tracing financial flows reveals the persistent structures of colonialism and imperialism in today's global economy. By examining historical currency systems, monetary policies, and capital movements, we uncover how colonial economic relationships continue to shape contemporary financial power dynamics.

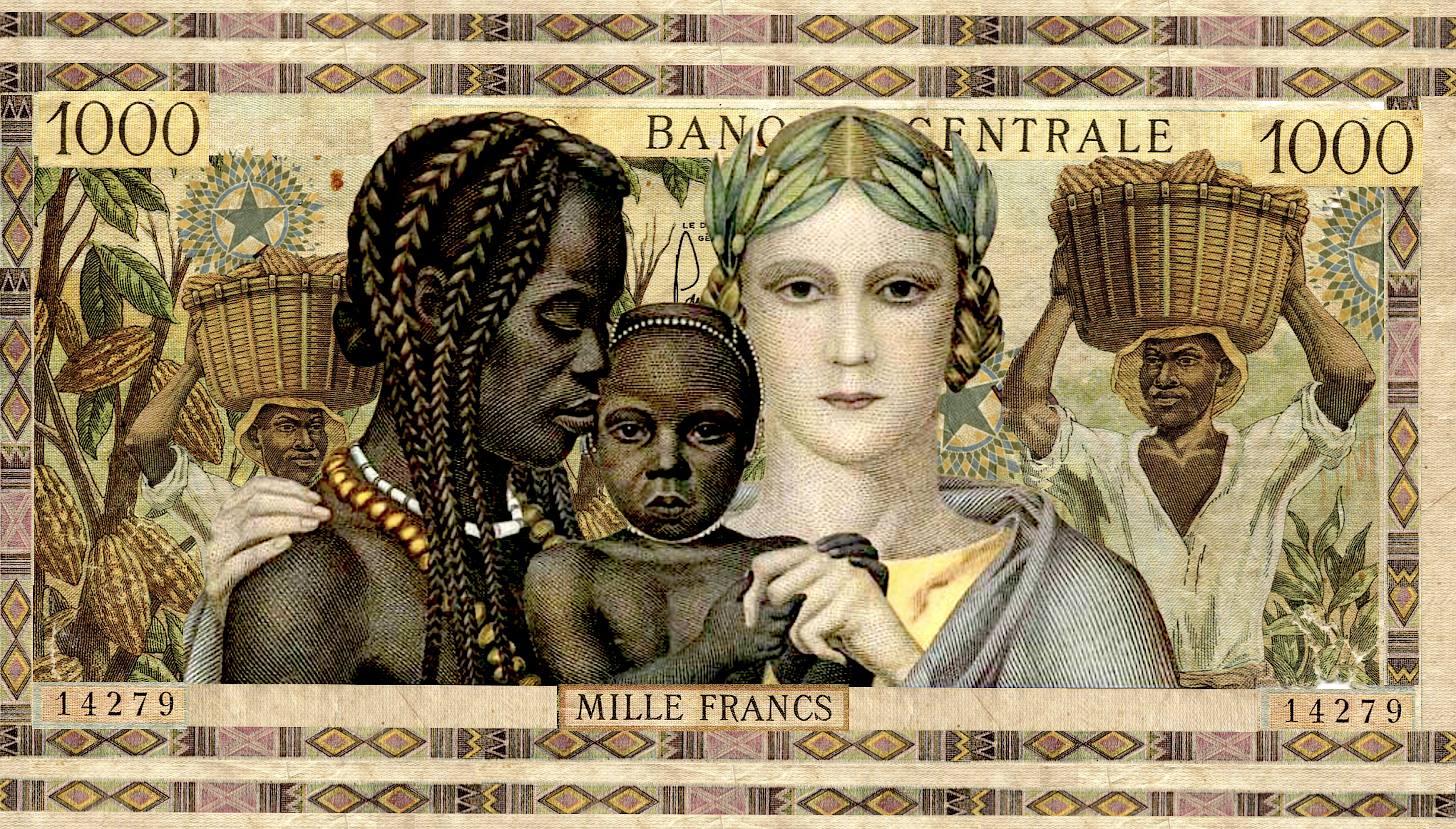

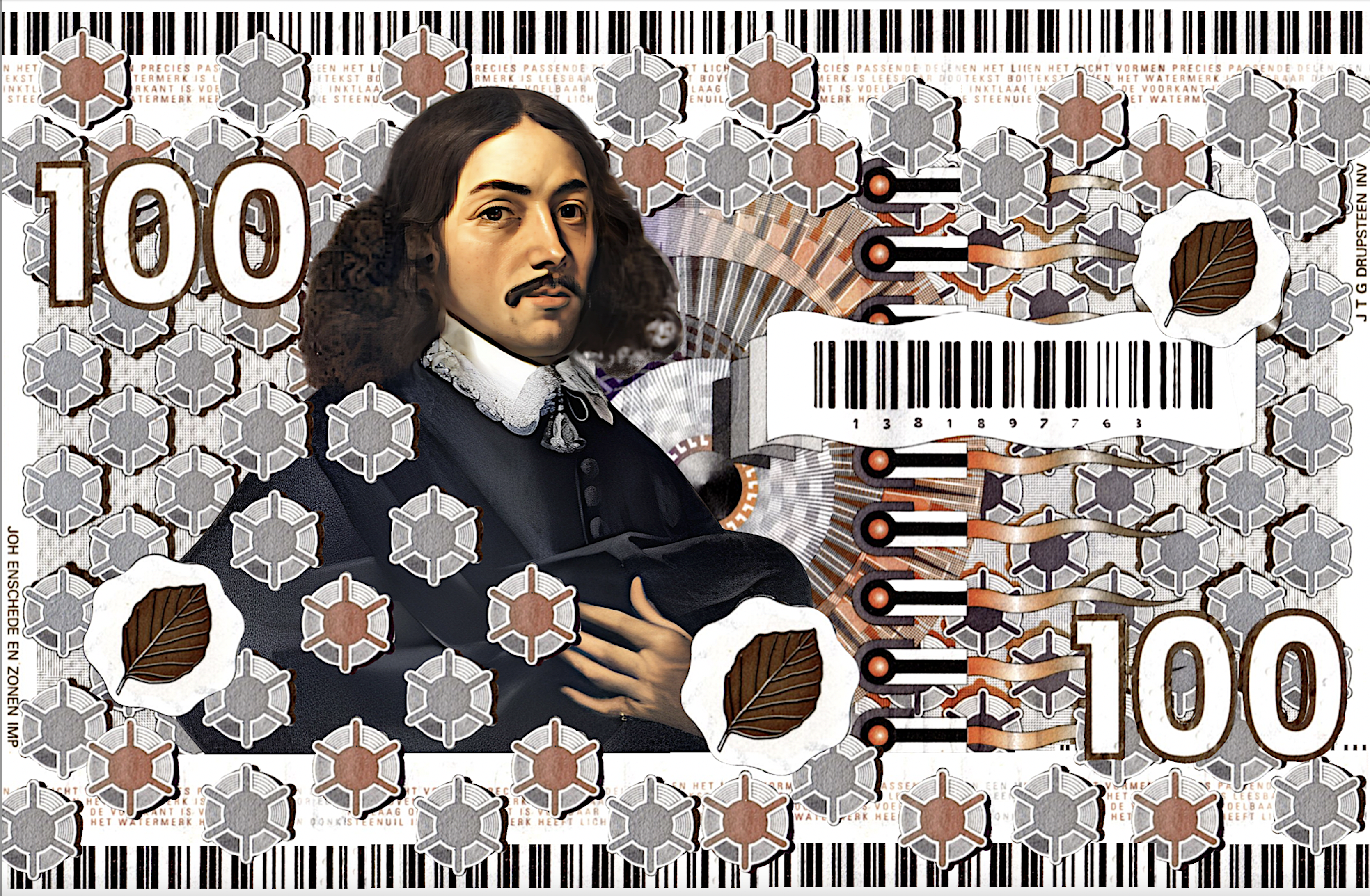

Historical Foundations: Colonial expansion relied heavily on monetary control as a tool of domination. European powers systematically imposed their currencies across colonized territories, dismantling existing economic systems and creating lasting dependencies. This section examines how the establishment of colonial currencies laid the groundwork for enduring economic hierarchies and financial power structures.

Currency as Colonial Infrastructure: The project investigates how currency systems served as fundamental colonial infrastructure, alongside railways and telegraphs. We explore how monetary policies were designed to:

- Facilitate resource extraction

- Create captive markets for colonial goods

- Establish banking systems that primarily served colonial interests

- Force colonized populations into wage labor economies

Contemporary Manifestations: Our investigation reveals how colonial-era patterns persist through:

- Modern debt relationships between former colonies and colonial powers

- The privileged position of certain currencies in global markets

- Extractive investment practices

- Unequal trade relationships

- Structural adjustment programs

Following the Money: This project traces specific financial flows to demonstrate how wealth continues to move from former colonies to colonial powers through:

- Global tax systems and tax havens

- Currency market mechanisms

- International debt structures

- Corporate profit repatriation

- Trade pricing systems

Methodology: We employ mixed methods including:

- Historical archive research

- Financial flow analysis

- Case studies of specific currencies and markets

- Mapping of contemporary capital movements

- Analysis of financial institution policies

Expected Outcomes: This project aims to:

- Document persistent colonial structures in global finance

- Map contemporary financial flows that perpetuate colonial relationships

- Identify specific mechanisms of financial extraction

- Propose frameworks for understanding modern monetary colonialism

- Contribute to discussions about decolonizing global finance